The global online gambling market is predicted to generate $59.79 billion of revenue in 2020 with a projected annual growth of 11.4% until 2026. Crucial to this continued growth is the industry’s global expansion within existing markets and into new emerging ones.

For the brands driving this expansion, choosing the right markets and understanding how existing ones are changing is imperative. For example, the rapidly developing legal landscape in the US presents new opportunities for brands that previously would not be able to operate in the country or target audiences there without – at the very least – treading into some legal grey areas.

In this article, we are looking at the markets that matter most for online casino brands.

Europe remains the world’s largest market in 2020

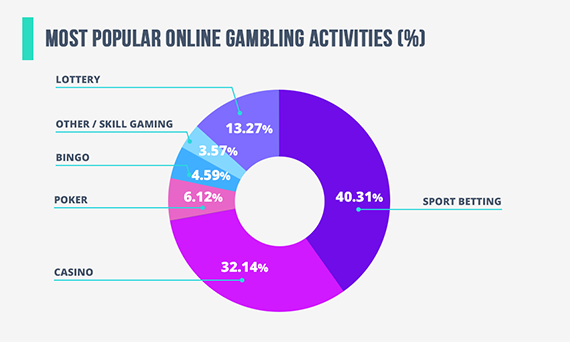

The European Gaming and Betting Association estimates that online gambling across Europe will reach €24.7 billion in 2020 – a 20% increase from 2017. The most popular online gambling activities in the region are sports betting (40.31%), online casino games (32.14%) and lottery (13.27%).

In 2017, the European Commission decided to stop regulating online gambling across the region, which means individual nations are now responsible for regulating their own sectors. This means the legal landscape can vary greatly across European nations and regulations can change relatively quickly.

Europe has always been one of the most complex regions in terms of language makeup, making specialist casino translation important. However, the legal landscape is far more complex now, too, since the EC decided to decentralise regulation.

Asia-Pacific region provides the most room for growth

The Asia-Pacific region is already the world’s second-largest online gambling market, accounting for 32.7% of the entire global market in 2018. Once again, the most popular online gambling activities are sports betting, online casino games and lottery, but the legal landscape for online casino games is very patchy – particularly in Southeast Asia.

In many countries, including mainland China, online gambling is illegal, but authorities are struggling to prevent betting companies based overseas from targeting their populations.

Despite strict regulation (at least on paper), the Asia-Pacific region remains the second largest in the world and it has got more room for future growth than anywhere else in the world. Technology adoption has boomed in the region and any changes in legislation open major opportunities – much like the Philippines’ decision to legalise casino websites approved and licensed by Philippine Amusement and Gaming Corporation (PAGCOR).

North America becomes a more lucrative market

Talk about the North American market in recent years has been dominated by the legalisation of sports betting in the US. However, online casino gaming has been legal in numerous parts of the country for many years, including the states of New Jersey, Pennsylvania, Nevada and Delaware.

Again, the legal landscape across the US is complex and the same can be said for Canada. However, regulations are constantly being reviewed as governments reassess the best ways to regulate and monetise an industry that people tend to indulge in, one way or another, regardless of its legal status.

What does this mean for online casino brands in 2020?

For online casino brands, the ever-changing legal landscape in the industry means that the fastest movers will have a major advantage if they are able to identify new market opportunities and establish themselves quickly. Brands need to keep a constant eye on the legal developments of key markets and be ready to launch as soon as they are legally able to do so.

At the same time, brands need to understand that simply launching in a country does not guarantee success. This is especially true in foreign-speaking markets where you need to engage with audiences in their own language and cater to their unique online gambling interests. Specialist casino translation, localisation and multilingual marketing strategies should be central to each move into a new market.